SHEFFIELD, UK (Sept. 12, 2023) – Connected insurance technology provider The Floow, an Otonomo Technologies Ltd. (Nasdaq: OTMO) company, today announced it has partnered with leading property and casualty insurer Definity (TSX: DFY) and Munich Re, a leading global provider of reinsurance solutions, to bring a new, innovative, usage-based auto insurance product to Canada.

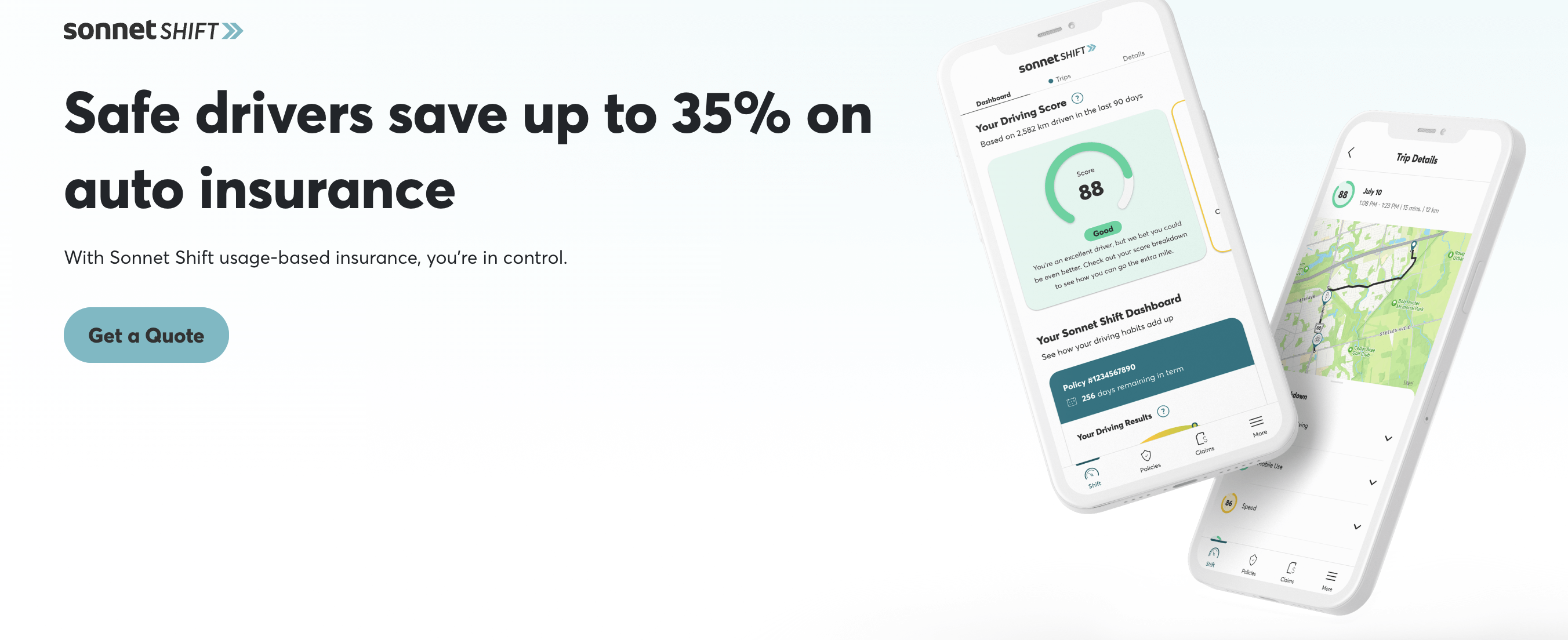

Definity’s new Sonnet Shift is the first ever UBI product in Canada to offer quarterly price adjustments based on recent driving scores. Powered by The Floow advanced telematics and Munich Re, Sonnet Shift uses individual driving behaviours and preferences as the main factor for pricing, including time of day, fatigue, smooth driving, speed, mobile distraction, and road risk.

The flexibility of FloowKit, The Floow’s software development kit (SDK), enabled Definity to build its highly customized insurance solution on top of The Floow’s foundation, resulting in a convenient, simple way for auto insurance customers to gain more control over their premiums.

The Sonnet Shift offering is based on driving behaviour scores, which have been consistently proven to predict claims, and therefore enable personalized pricing. The mobile app uses telematics data captured and scored by The Floow to generate three user-based rate pillars:

- Behavioural Score – Customers benefit from a fair price based on their actual driving behaviour.

- Mileage Contribution – Mileage driven by each driver on the policy is analyzed and weighted quarterly to derive an updated premium based on usage.

- Mileage Discount – At policy renewal, customers are eligible for annual mileage discounts if actual kilometers driven fall within predetermined levels.

“The launch of Sonnet Shift is the latest example of Definity’s commitment to making insurance better for our customers and the communities we serve,” said Paul MacDonald, Executive Vice-President, Personal Insurance & Digital Channels, Definity. “Through our partnership with The Floow, we are able to bring an entirely new product to the Canadian insurance market that exemplifies the future of insurance.”

This new product represents a pivotal step forward for the Canadian auto insurance market, at a time when consumer demand for usage-based insurance is on the rise in Canada, increasing nearly 20% from 2022 to 2023, according to data from RATESDOTCA.

“Usage-based rates are the future of auto insurance,” said Aldo Monteforte, CEO of The Floow. “We are delighted to support top insurance companies like Definity, powering their connected insurance strategies and transforming the way auto insurance is written and managed. Definity is leading the way and we are delighted to partner with them to bring their innovative solution to auto insurance customers in Canada.”

The Floow and Munich Re Global Consulting were selected by Definity following a competitive RFP process.

“Advancing transformative change in the auto insurance industry demands a significant, collaborative commitment by industry leaders and innovators,” said Falk Albers, Partner, Global Consulting, Munich Re. “In the case of Definity’s new UBI product, three organisations have come together to move the industry forward. That’s the reason we established a global strategic partnership with The Floow – bringing cutting edge technology, know-how and consulting to our clients.”

To learn more about Sonnet Shift, visit https://www.sonnet.ca/shift.

For more information about The Floow’s connected insurance technology, visit https://www.thefloow.com/our-solutions.

For more information about Munich Re Global Consulting, visit Munich Re’s cutting-edge telematics solution | Munich Re.

About Munich Re

Munich Re is one of the world’s leading providers of reinsurance, primary insurance and insurance-related risk solutions. The Group consists of the reinsurance and ERGO business segments, as well as the asset manager MEAG. Munich Re is globally active and operates in all lines of the insurance business. Since it was founded in 1880, Munich Re has been known for its unrivalled risk-related expertise and its sound financial position. It offers customers financial protection when faced with exceptional levels of damage – from the 1906 San Francisco earthquake through Hurricane Ida in 2021. Munich Re possesses outstanding innovative strength, which enables it to also provide coverage for extraordinary risks such as rocket launches, renewable energies or cyber risks. The company is playing a key role in driving forward the digital transformation of the insurance industry, and in doing so has further expanded its ability to assess risks and the range of services that it offers. Its tailor-made solutions and close proximity to its customers make Munich Re one of the world’s most sought-after risk partners for businesses, institutions, and private individuals.

About The Floow (an Otonomo Company)

The Floow’s mission is to make mobility safer and smarter for everyone. Its user-friendly telematics platform provides drivers with actionable insights and engagement propositions that improve safety and loyalty, and allow insurers, fleet companies and auto manufacturers to make more informed and profitable decisions. More information is available at thefloow.com.

Media Contacts:

The Floow

Share this article